I hope you are going to enjoy reading my piece on Gaming Innovation Group Inc. (GIG) as much as I enjoyed writing it. I wanted to take a shot at researching a company that is not listed in Warsaw for a while. The inspiration to look into GIG came from this story.

All presented information is author's private opinion and does not constitute investment recommendations. Despite being diligent, the published content may not contain all necessary information, and the presented valuations may be based on incorrect assumptions. The opinions presented are current as of the date of publication. The author is not obligated to update previously published analyses. The author is not responsible for investment decisions made based on the presented materials. Always remember to conduct your own research. The key to success in investing is to protect your capital. The author may own shares of the discussed companies.

iGaming

Before looking into GIG, I think it is very beneficial to understand what iGaming industry is. iGaming is a wide term coined to describe the business of online gambling. It includes such areas as sports betting, casino games and skill games such as poker. Most companies in the sector can be classified as operators, suppliers or affiliates.

Operators run sports betting or casino operations and deal directly with consumers. The companies such as Flutter, William Hill, Betsson and 888 can be used as examples.

Suppliers predominantly develop technology solutions for operators, but this category also includes game suppliers and odds suppliers. The important players in this area are Scientific Games, IGT, Kambo, PlayTech.

Affiliates promote brands owned by operators and recruit new players. Companies worth highlighting in this area are Better Collective, Catena Media, XL Media.

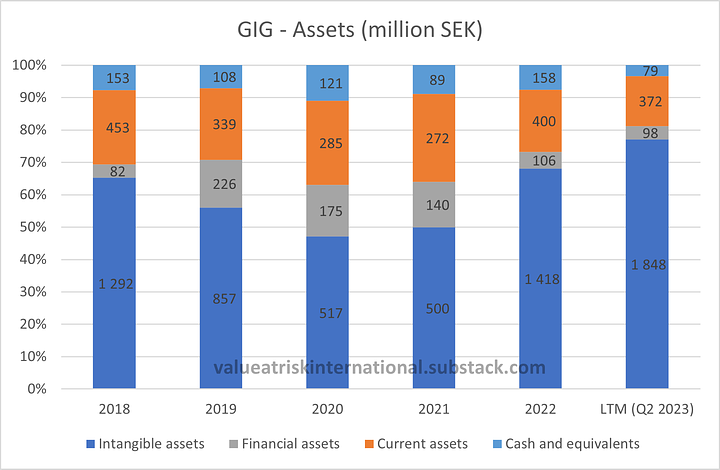

Online gambling has become a very significant industry. According to Statista, the worldwide revenue of online gambling sector is set to reach $132 billion by 2027.

Worldwide revenue of online gambling:

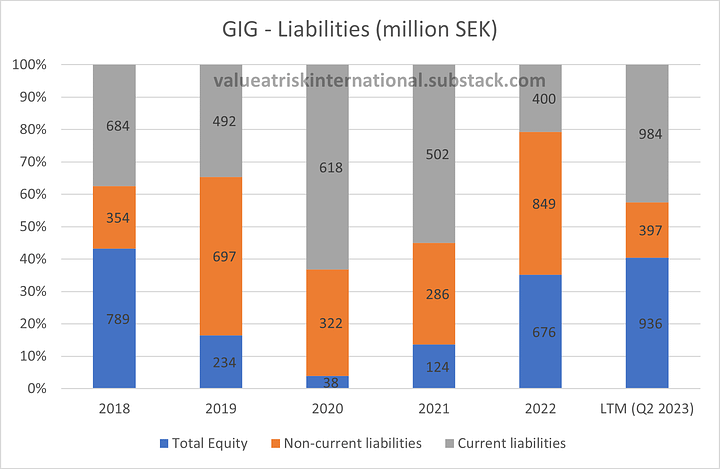

Users of online gambling platforms by activity type:

According to Flutter, online betting represented roughly 30% of total market in 20221. This means that the runway for iGaming is still very significant. iGaming sector benefits from the following secular trends:

Similar to online shopping, more and more people enjoy online entertainment.

Technology advancement allows for better gaming experience (for example “live dealer games” through streaming).

Growing popularity of mobile gaming.

Online payments are becoming easier and more secure.

Positive global regulatory momentum (especially US and LATAM).

The legal issues around gambling are very complex. The regulations get changed often and they can be very different in each country. There are many grey areas. Any company in the industry has to constantly work hard to keep up with regulations. Regulators fine operators for misconduct quite frequently.

Gaming Innovation Group

GIG was established in 2008 and went public in 2015. The original vision of the company was to disregard traditional specialisation and to get involved in all the areas of iGaming to take advantage of synergies between segments. The strategy turned out to be difficult to execute and the company struggled. Robin Reed who founded the company and served as CEO was fired in 2019. The former COO Richard Brown was appointed as the new CEO. He took numerous difficult decisions to take the company around. Among many other, he closed the game development studio and decided to expand media business. Consumer facing business has been sold to Betsson. “White-label” (renting out the licenses to other operators) business has been closed. As a result of all the changes, GIG became fully focused on B2B offer.

Currently, there are two business lines within GIG. which effectively constitute two separate businesses:

Media;

Platform & sportsbook.

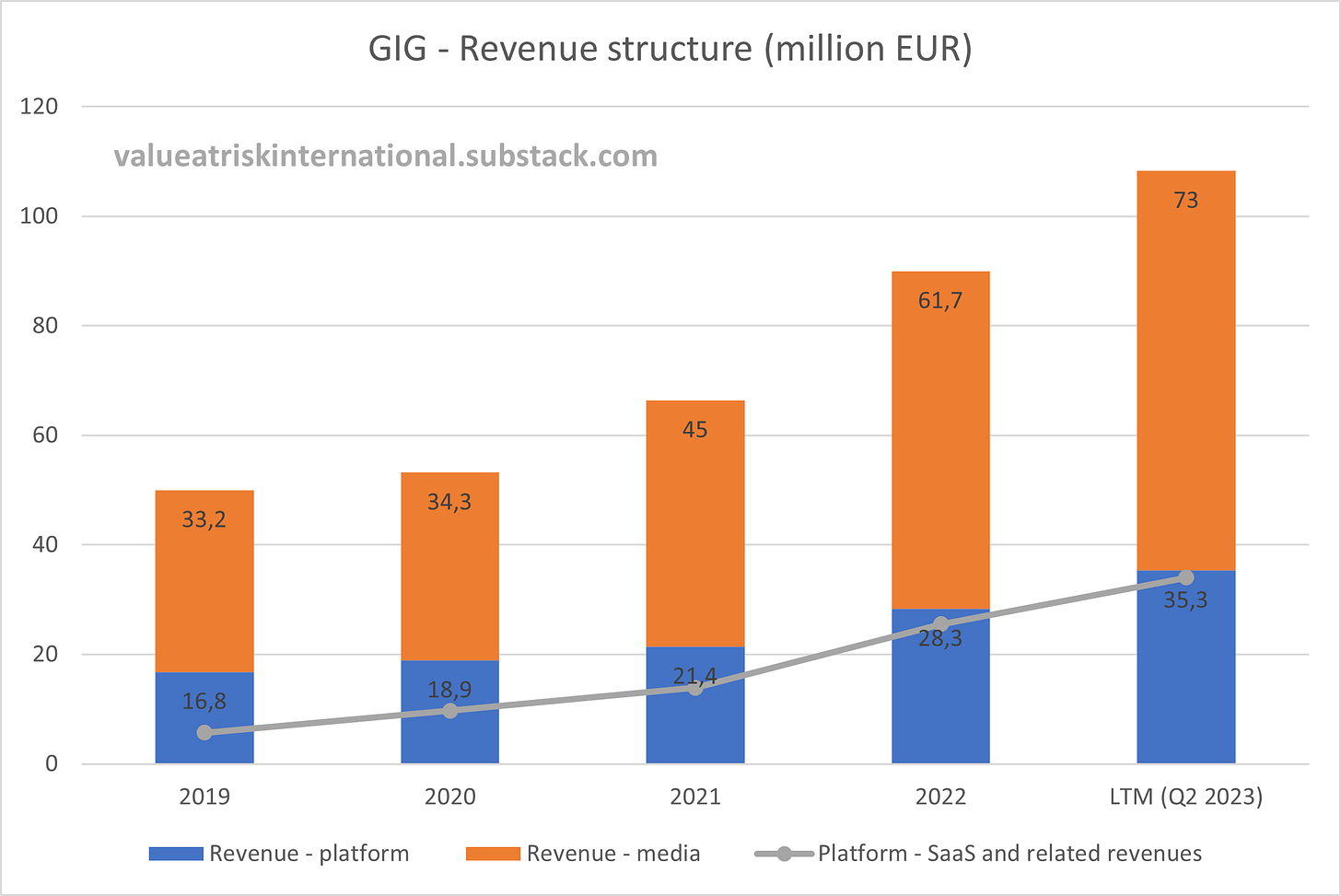

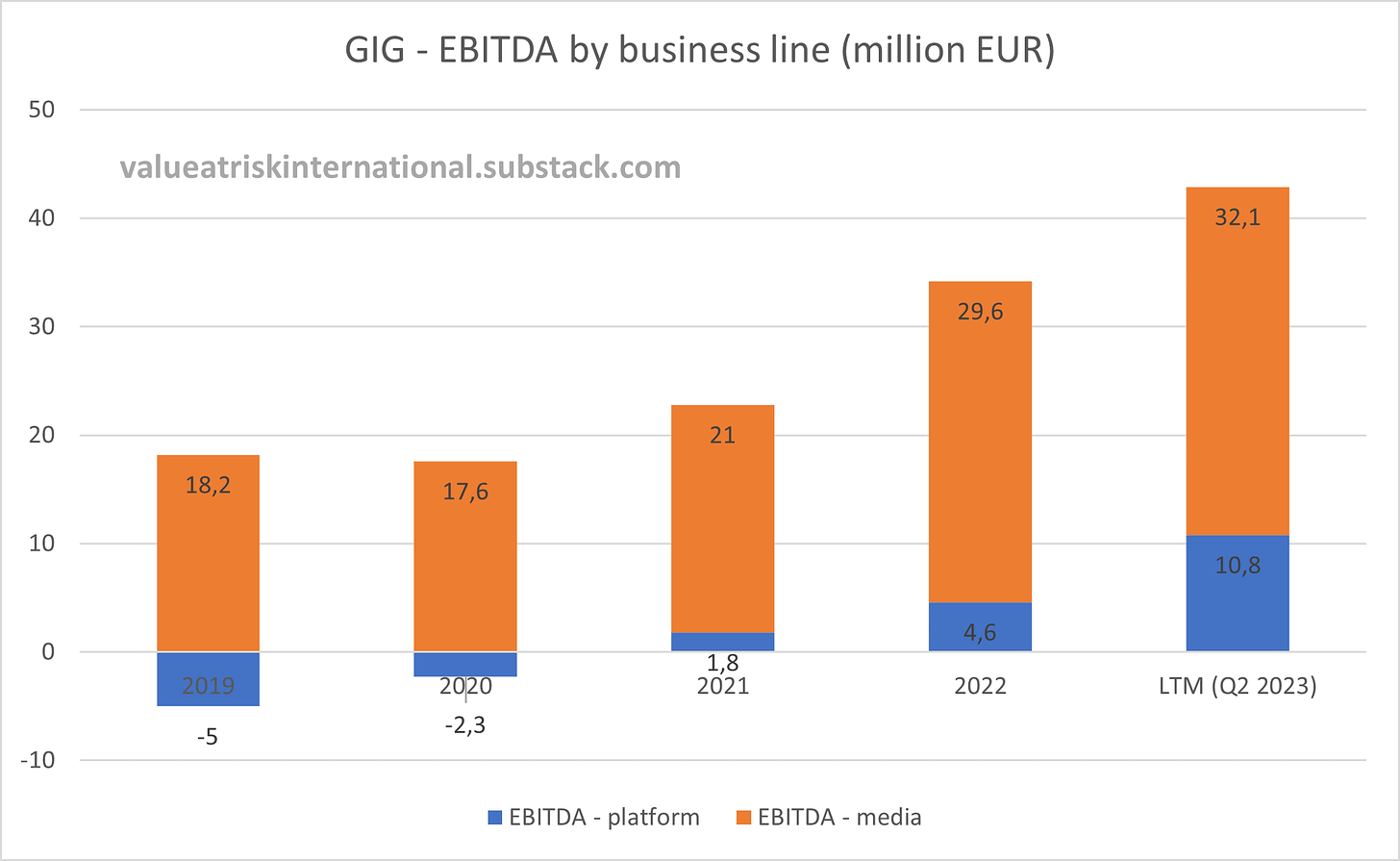

Media brings in 67% and platform & sportsbook 33% of total revenue. This split has been fairly stable over last couple of years.

In terms of EBITDA, Media contributes 75% and platform & sportsbook - 25%.

GIG conducts business in regulated markets only. The company holds licences to operate in 38 markets, which makes it a global company. Recently it strengthened its position in North America by getting an Online Sports Wagering Operator Licence in Maryland and a full Interactive Gaming Manufacturer License in Pennsylvania. GIG also holds licenses in New Jersey, Iowa and Ontario.

Geographical structure of revenue is very diversified with no market having a share bigger than 10%. Thanks to recent regulatory changes, LATAM business is growing very fast.

At the end of the second quarter 2023, 631 employees were spread throughout Malta, Spain, France, Denmark and Serbia. Approximately 365 people contributed towards Platform & Sportsbook, 240 were focusing into GiG Media with the balance in corporate functions. The above numbers include approximately 90 full time consultants and remote workers with which at present GiG collaborates across Europe, Asia and USA. Additionally, GiG is contracting approximately 100 outsourced tech resources to be dedicated to the delivery of key projects.

The personnel are 50% employed in Malta, 24% in Spain, 10% in Denmark, 10% Serbia, 6% in France2.

GIG has announced plans to split the company into two independent entities in the future. Both of the companies are going to be listed. As GIG progresses towards the strategic change, it was agreed that Richard Brown is going to step down at the end of 2023. Media will be led by current CMO - Jonas Warrer. Platform & sportsbook will have a new CEO - Richard Carter3. Full details of the split are expected by the end of 2023, but GIG should transform into two independent publicly listed companies in H1 2024.

The Company remains confident and committed to its long-term financial targets which are as follows:

Growth: To achieve annual organic revenue growth in the region of 20%.

Profitability: To achieve an adj. EBITDA margin in excess of 50% during 2024.

Leverage: Cash generated from the business will be used to lower leverage

ratio while continually pursuing growth opportunities in the rapidly growing

iGaming sector4.

GIG made bad decisions in terms of capital allocation in the past and had to scale back its operations. As the strategic review started to pay off, the company became interested in chasing opportunities for expansion.

On 1st of April 2022, it was announced that GIG acquired 100% of the shares in iGaming company Sportnco Gaming SAS. 27.87 million EUR has been paid in cash and 23.50 million EUR in 12,623,400 new shares in GiG at a share price of NOK 18.08.

On 31st of January 2023, press release stated that GIG signed an agreement to acquire the casino affiliate websites Askgamblers.com, Johnslots.com, Newcasinos.com and several smaller domains from Catena Media Plc. The transaction has been carried out through a share purchase by Innovation Labs Limited (GiG Subsidiary). The amount paid is 45 million EUR (paid in 3 instalments with the last one being due on 31st of January 2025)

On one hand, it is great to see the company being ambitious and the revenue growing, but given the recent history, one can ask very valid question if aggressive M&A strategy can again result in bad capital allocation and future restructuring.

Media

Media segment of GIG is an affiliate business. GIG operates multiple websites, where content for customers interested in online gambling is published. GIG is paid for delivering new customers to operators. When a customer opens new account with an operator and deposits money for the first time, GIG starts to be compensated.

Most of the time, revenue share model applies (those deals generate roughly 65% of revenue). Revenue share means that part of the money lost by the customer is distributed to affiliate for the lifetime of the account, so there is a snowball effect. As long as GIG is able to attract new customers through the content they publish, the revenue should grow. Apart from revenue share, GIG can be compensated through CPA model (cost per acquisition) which is a one-off payment for referred customer that makes a deposit with an operator. Additional fees can also be charged for prominent positions of advertising on GIG’s websites.

GiG Media refers users to operator partners across casino, poker and sports betting, mainly by operating websites that rank high in search results for specific keywords and pay-per click advertising. The vision is to enhance touchpoints where people discover iGaming online by emphasising educational, informational, and valuable content about the industry and promoting top-tier games, operators, and offerings through web portals and online campaigns. Media Services generates revenue through perpetual revenue share agreements, cost per acquisition (CPA), hybrid models, and listing fees for prominent positions on our websites. Affiliate marketing offers solid margins and benefits from economies of scale, making GiG Media one of the leading iGaming affiliates for revenue and traffic-driving capabilities.

GiG Media delivered an all-time high in revenues in 2022, up 37% from 2021, continuing the positive development over the past years. Player intake continues to be strong and reached 352,000 first time depositors (FTDs) in 2022, up 78% from 197,800 in 20215.

There are two ways for Media services to recruit new players:

Publishing - good quality content that will have high ranking on Google is created. Once there is traffic on the website attracted by the content, potential customers can click one of the links that would refer to the operator’s website.

Paid - GIG takes risk and buys advertising space online (Search Engine Marketing, Display and Banner Advertising, Social Media Marketing, and Permission Marketing/CRM) for their own account to find new customers for operators. This is where companies can build most of their competitive advantage. It requires to employ cutting-edge technology to manage ads in such a way that target ROI is achieved. In 2017, to get more know-how in this area, GIG has acquired performance marketing specialists - Rebel Penguin Agency.

In Q2 2023, the revenue structure of GIG Media was as follows:

Publishing - 53%

Paid - 47%

GIG operates 100+ casino and sports websites. The most important ones with global reach are wsn.com, askgamblers.com and casinotopsonline.com. There are also many websites tailored to the needs of specific markets. GIG media also looks for external partnerships with the most notable one being the one with News Corp. GIG operates a betting-focused section on The Sun and talkSPORT's websites.

Examples of key websites run by GIG Media:

Website performance in July 2023:

As the products, on B2C market get more commoditized, player acquisition becomes even more important. With marketing budgets already stretched, working with affiliates is the way to make sure that money is spent effectively (paying for actual effect as opposed to general campaign).

While overall regulatory trends are favourable for GIG and its clients, Media business is facing a risk, where certain countries may decide to impose full ban on gambling advertising, which could restrict the ability for GIG to carry out affiliate business.

Platform & sportsbook

Platform side of business is more complex than media. The GIG’s vision is to offer end to end solution for operators who want to set up their online presence. It can be either to expand existing brick and mortar setup (creating omnichannel experience) or to take already established online operation into new markets. All features and functionality are offered as a Software-as-a-Service (SaaS). SaaS revenue constitutes more than 95% of total platform & sportsbook revenue.

Currently, many operators are very keen to use third party solutions instead of in-house development to save cost. The big advantage of GIG’s offer is that the operator has to deal just with one counterparty. There is no need to integrate for example payments, games, back office separately as all the services are bundled together. GIG acquired Sportnco in April 2022 to have a complete solution including sports betting. Sportnco offers odds on more than 50 sports and 50 000 events in the world’s biggest and most popular sports leagues.

GiG delivers world-class igaming platform solutions and services to operators and their customers, via innovative and scalable technology. Our next-generation iGaming platform, composed of Player Account Management (“PAM”), Front-end, Back office and managed services is purpose-built for complex regulated markets and allows for accessible and compliant market entry into more than 30 regulated markets around the world. We specialise in helping our partners expand their business on a global scale, as our agnostic platform allows for innovation and customisation adapted to individual needs, localised customer experiences and user journeys. To provide a flexible solution, our platform rapidly integrates with partners’ existing technology, preferred third parties as well as leading payment and game content providers. This allows operators to choose freely which content and services are best suited for their players' needs, providing the support needed to match their growth aspirations and localise their brands.

The GiG Sportnco sportsbook combines an innovative and proprietary product with an unparalleled geographical footprint, following the acquisition of Sportnco by GiG in April 2022. Our sportsbook offers a complete end-to-end solution with the sportsbook and platform combined, to allow for a seamless user experience for all operators. Our partners benefit from one single integration point, and facilitate their onboarding and launch. Now a truly global offering, the GiG Sportnco Sportsbook enjoys access to over 30 markets, focused on flexibility to deliver tailored odds, personalised margins and tailored strategies to specific regulated markets6.

Products and services offered by GIG Platform & sportsbook:

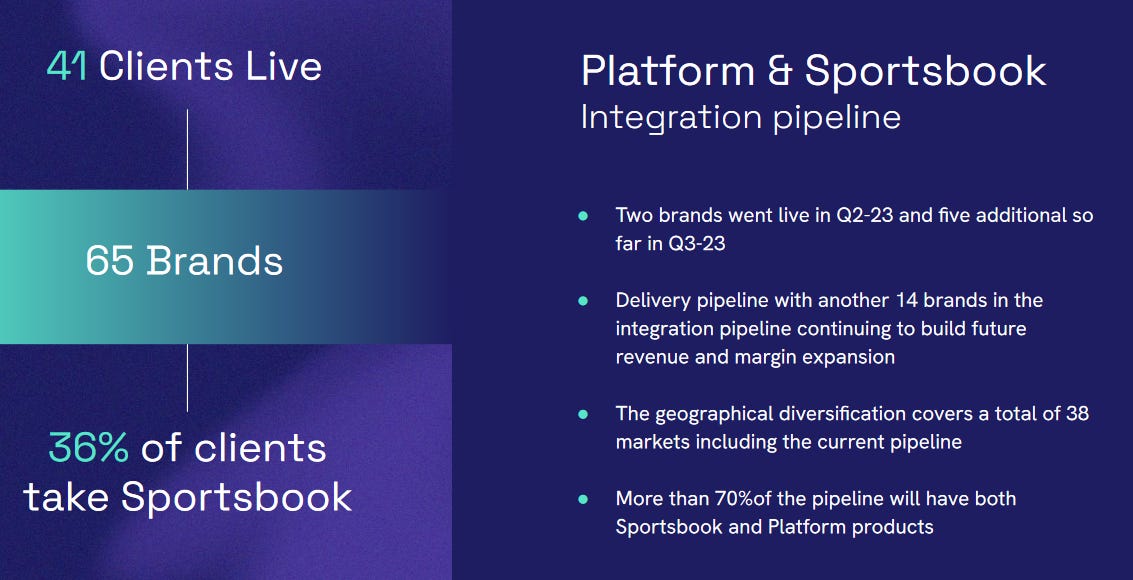

From the perspective of future revenue growth, it is worth noting that, there are many clients, where agreements are already signed, but the launch has not happened yet. Therefore it is very likely, the revenues of platform & sportsbook business is going to keep on growing over next quarters. At the same time, there are new clients coming in. In 2023, the sales team has managed to sign 9 new clients. In 2022, 22 new agreements were signed. Currently there are 41 clients live in total.

Notable clients of platform and sportsbook services are as follows: Betsson, SkyCity, Aspers UK, Crab Sports, Full Games, Betway, Grupo Boldt (Bplay), Fenibet, Strike Games, Luckybet, Luckydays and Spinaway, StarCasino.

GiG is very transparent and shares updates on new contracts with clients. There are some interesting news this year:

GiG signs Head of Terms with established European land-based Casino

Gaming Innovation Group completes acquisition of AskGamblers

GiG completes a deal with Ontario land-based group to power Casino Time

Gaming Innovation Group expands strategic commercial partnership with News UK

Gaming Innovation Group awarded licences in Pennsylvania and Maryland.

Gaming Innovation Group signs platform deal with Palasino.

Gaming Innovation Group extends GiG Comply deal with bet365.

Gaming Innovation Group helps launch GoldenPark in Portugal

Gaming Innovation Group power Crab Sports launch in Maryland, US

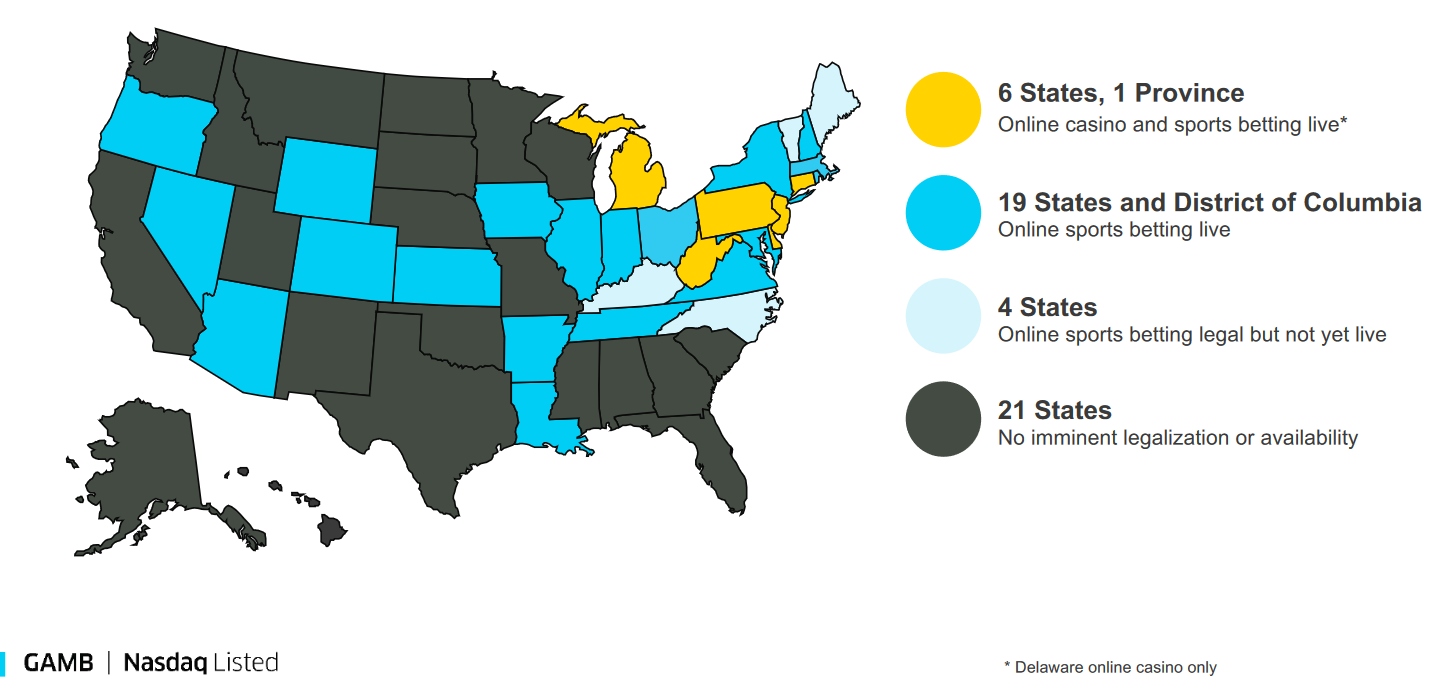

GIG is very keen to grow its presence in US market. One of GIG’s clients - Crab Sports has recently started operations in Maryland using both platform and sportsbook delivered by GIG.

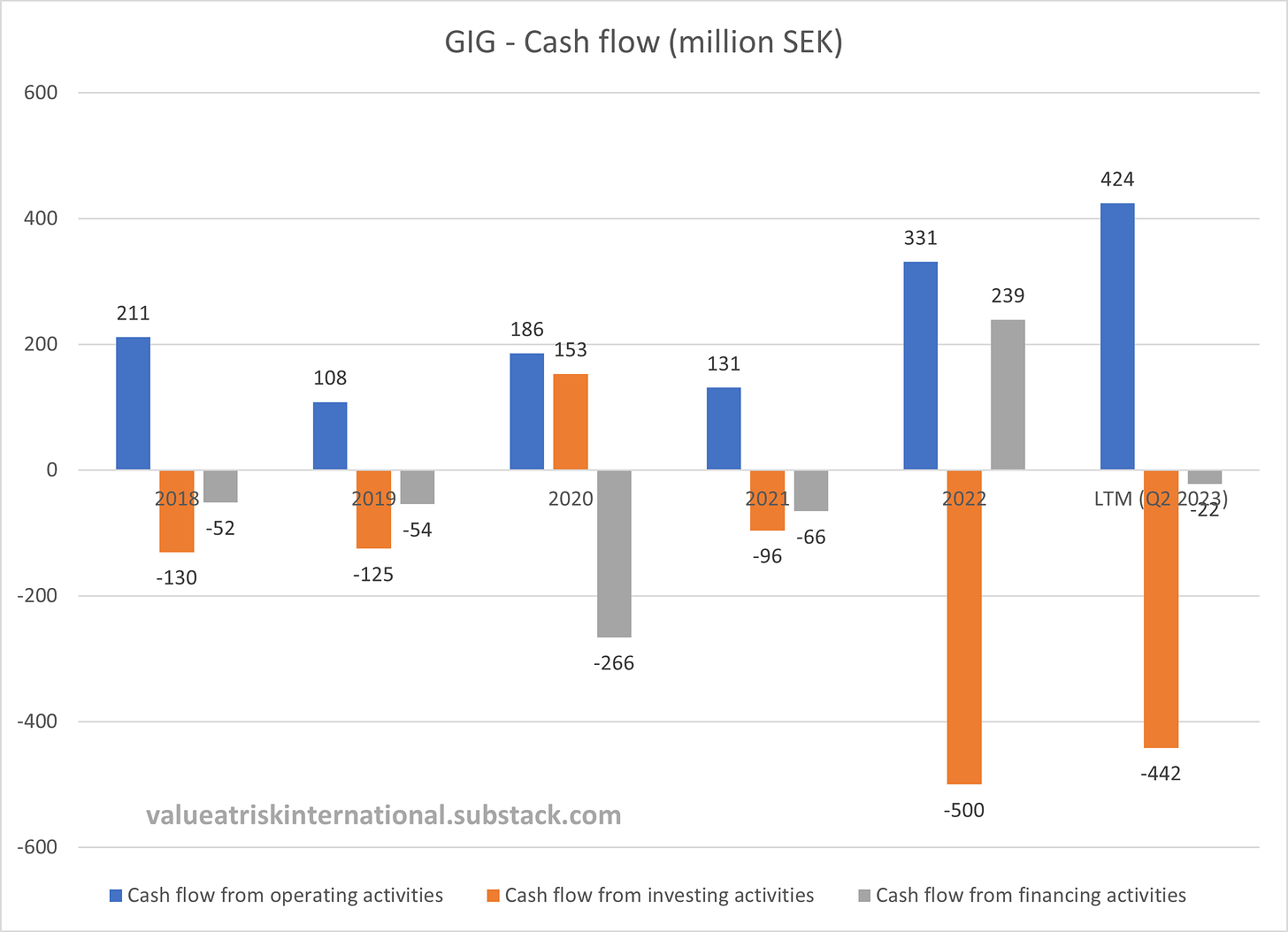

Financials

All the charts in this section except for “expenses” were created using borsdata.se data.

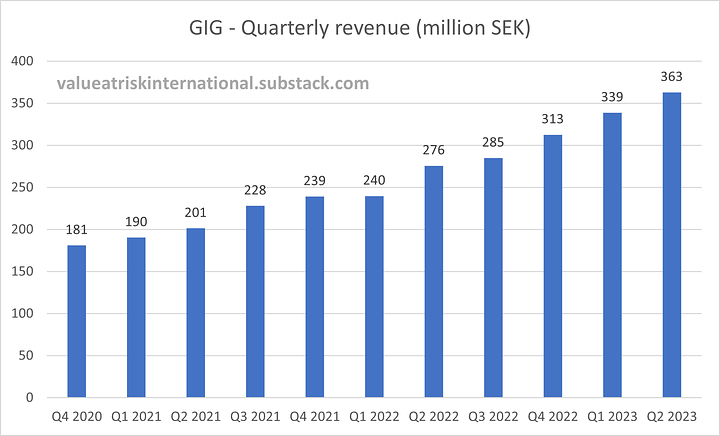

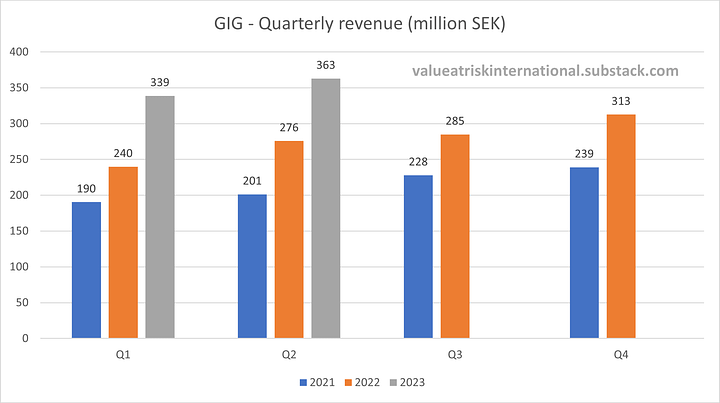

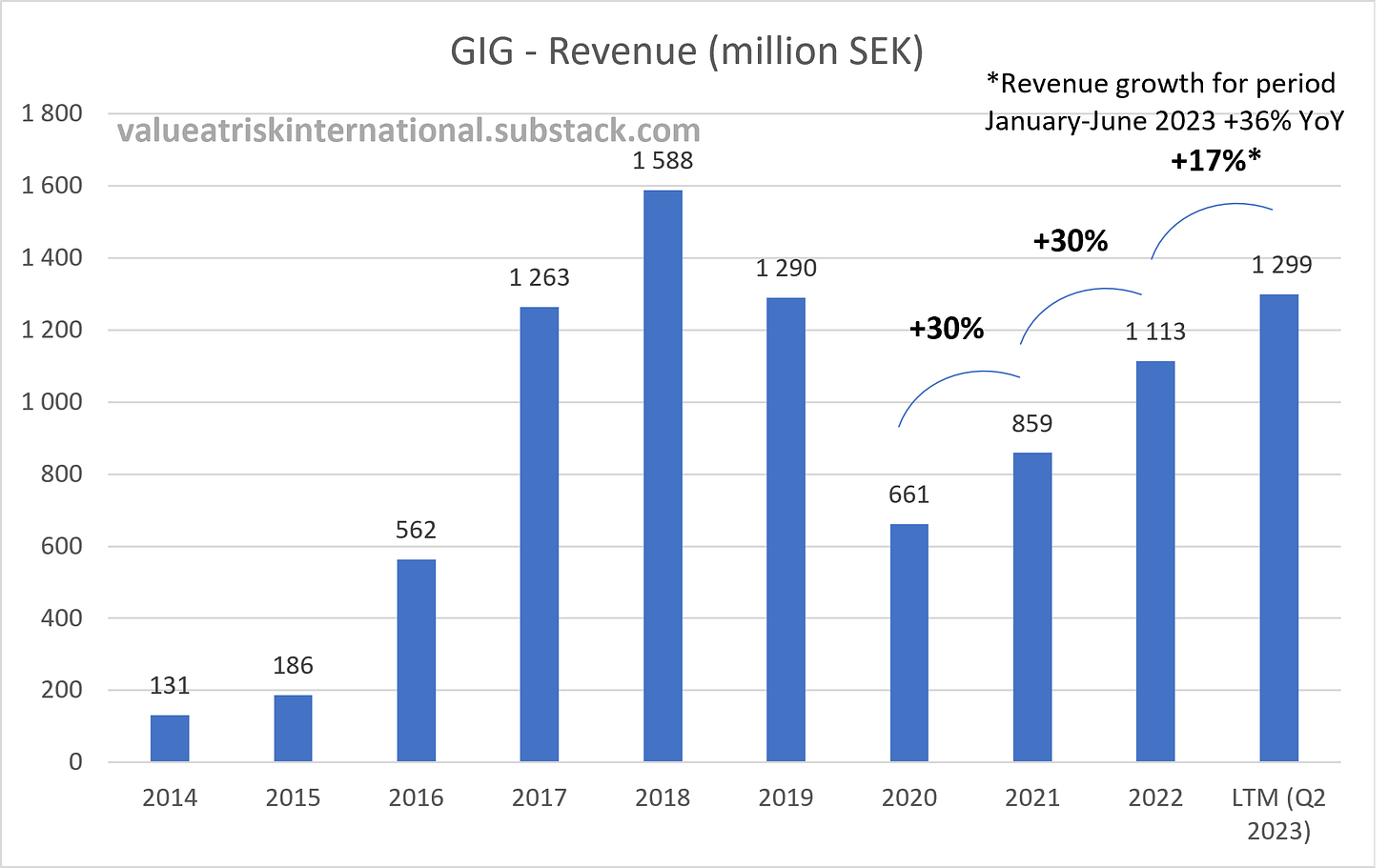

The revenue for last twelve months amounts to 1 299 million SEK (as of June 2023). Revenue growth for period January-June 2023 is 36% YoY.

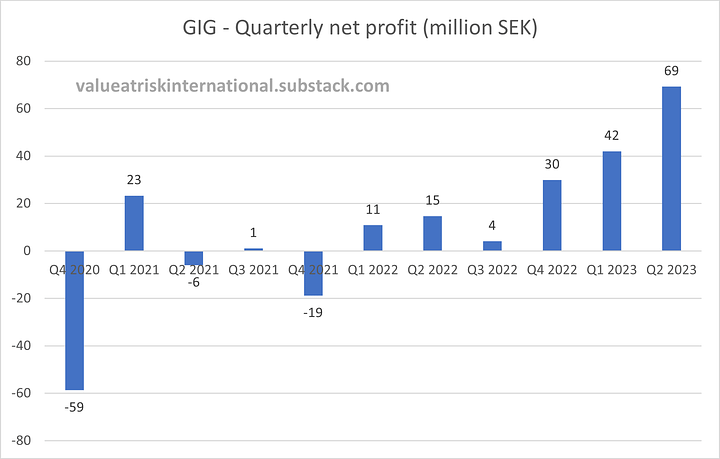

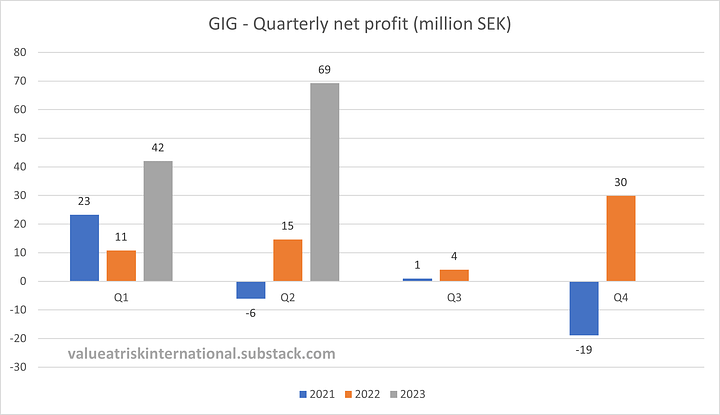

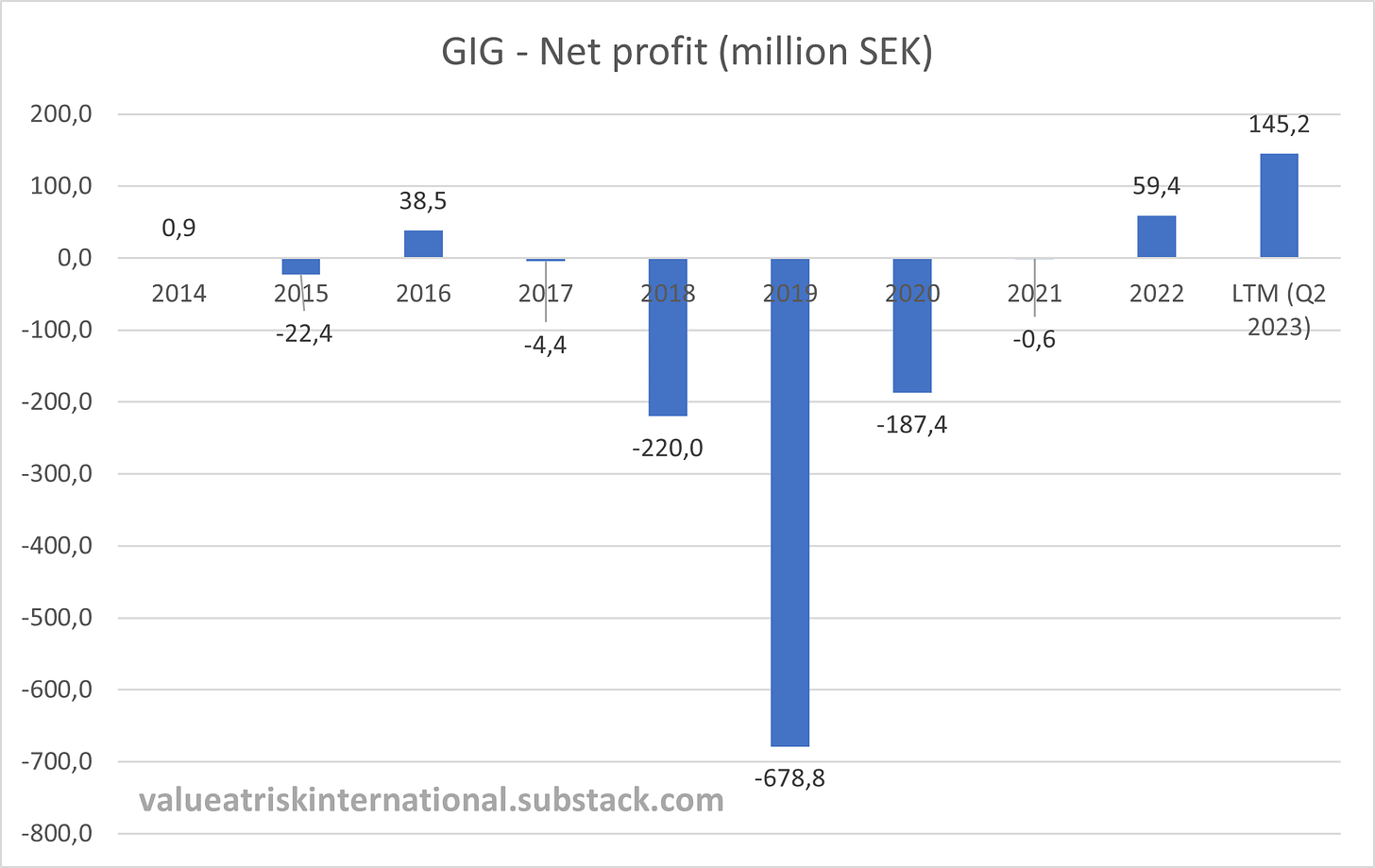

Thanks to operational leverage, net profit is growing faster than revenue. Net profit for last twelve months amounts to 145.2 million SEK.

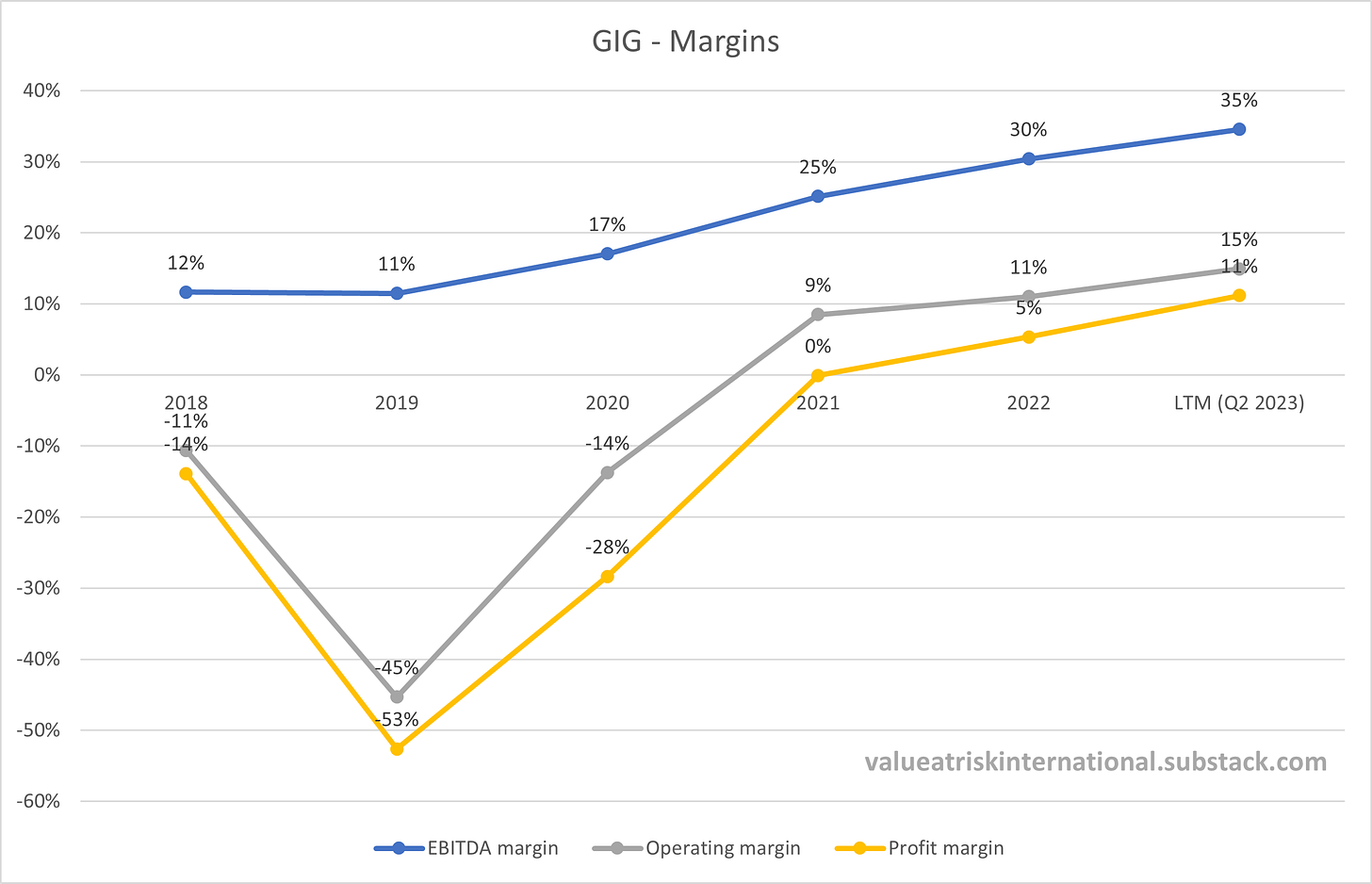

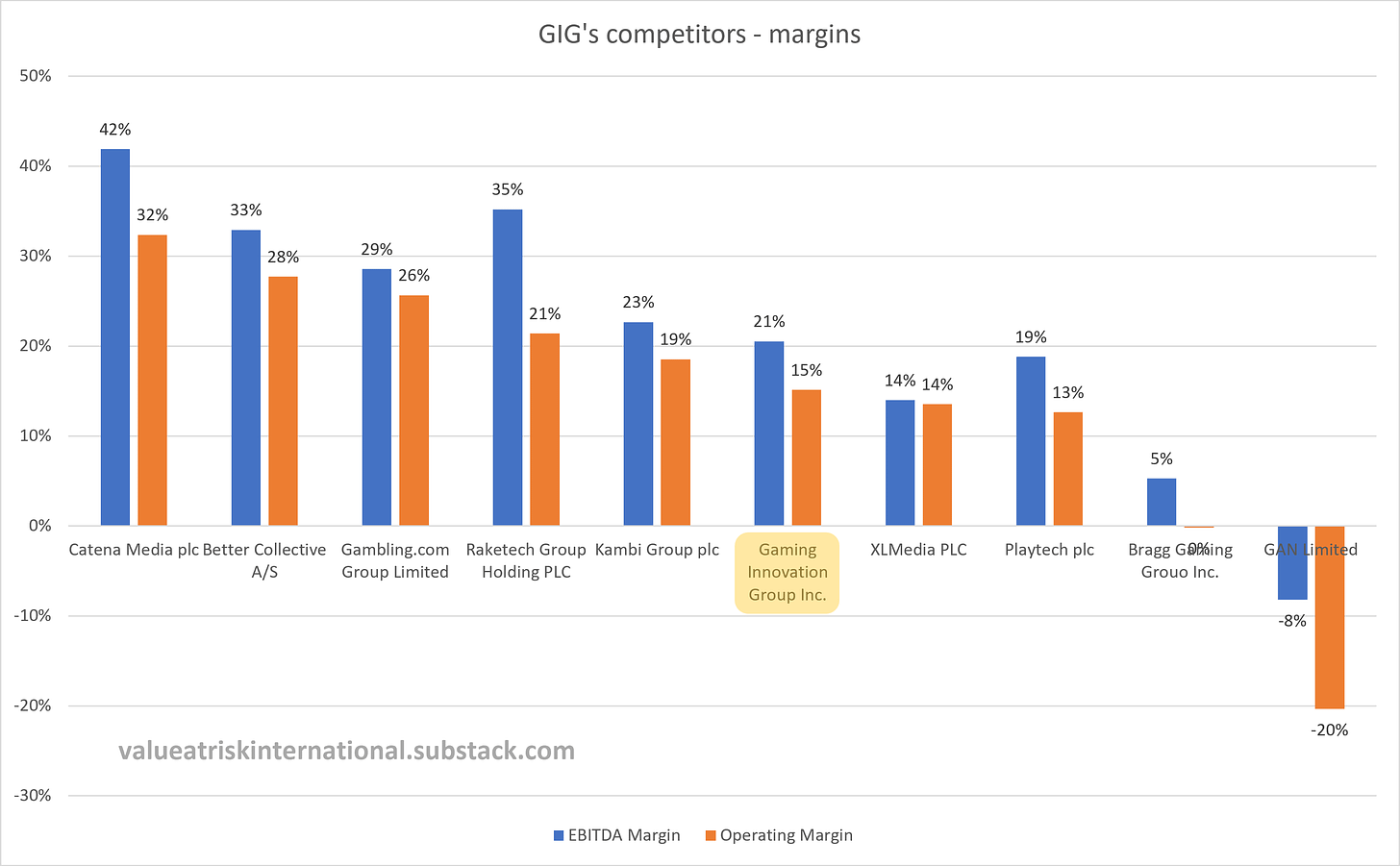

As revenue grows, profitability is improving with EBITDA margin steadily moving towards the target of 50%+.

It is not very common to see a company with such an impressive QoQ revenue and net profit growth trend. Quarterly results are presented in the gallery below to make the content easier to read. Please click on each chart to expand.

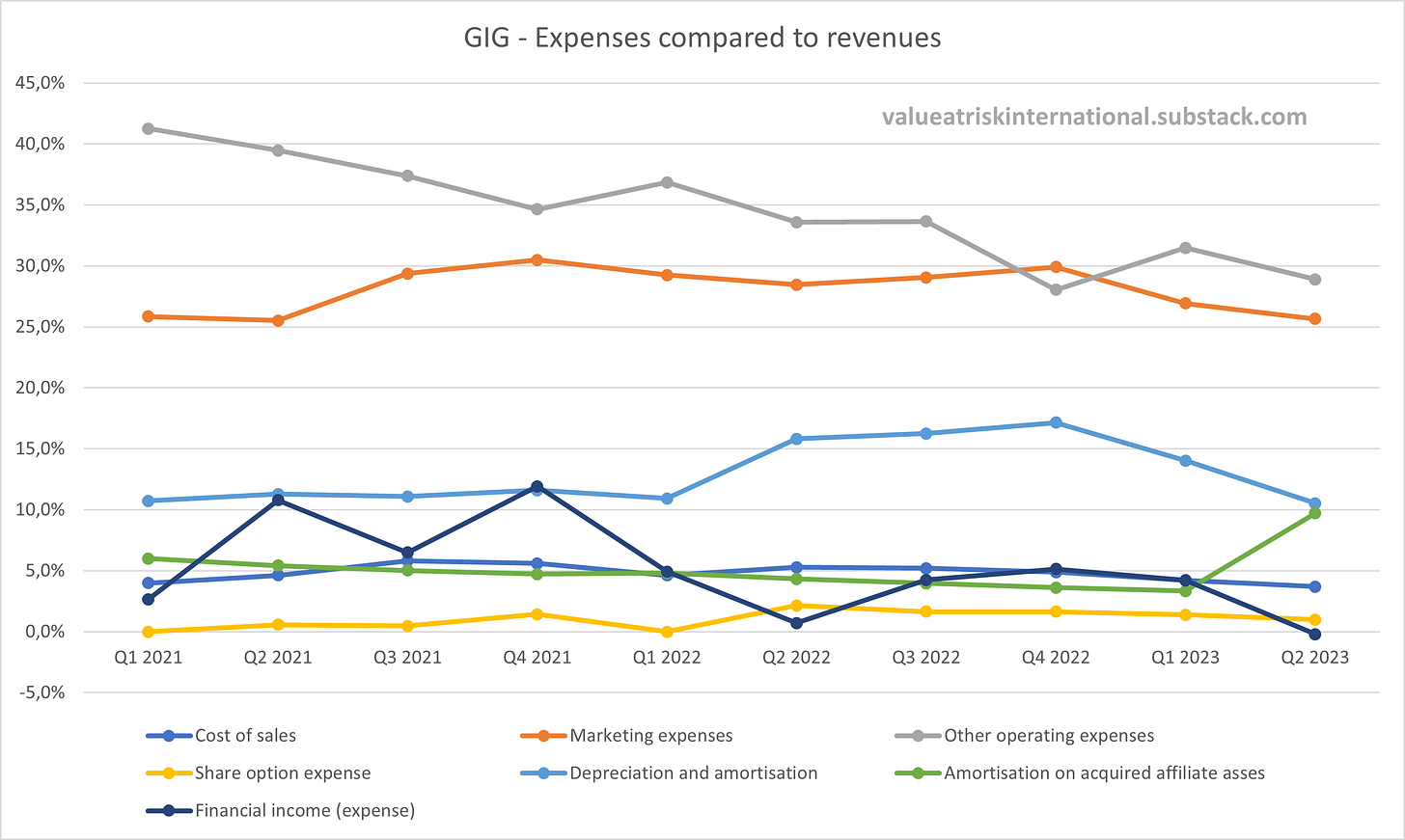

The main category of expanses is “other operating expenses” which mostly constitutes of personnel and general corporate expenses. Total expenses in Q2 2023 amounted to 35 million EUR. The chart below presents all the categories of expenses in relation to revenues.

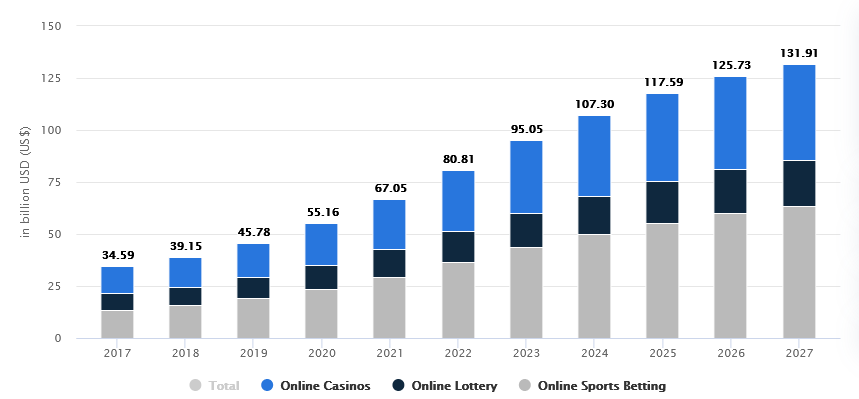

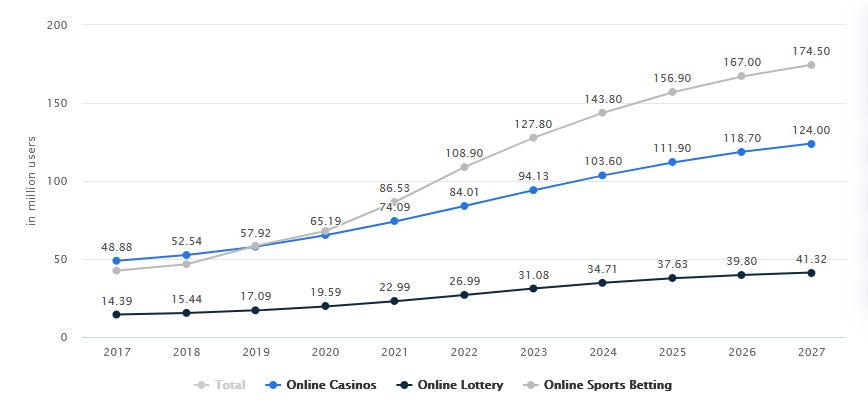

Due to the nature of the business and recent acquisitions, balance sheet is heavy in terms of intangibles (with roughly 50% of intangibles being goodwill). It is easy to be impressed with recent developments in the income statement but it all comes with liabilities.

Summary of key items as of Q2 2023:

Current liabilities:

45.8 million EUR - bond payable.

In June 2019, Gaming Innovation Group Plc. issued a SEK 400 million senior secured bond with maturity in June 2022. In June 2021, the 2019-22 bond was refinanced through the issuance of a new 3-year SEK 450 million senior secured bond with more favourable terms and a SEK 550 million borrowing limit. The new bond has a floating coupon of 3 months STIBOR + 8.50% per annum. In January 2022, GiG successfully completed a SEK 100 million subsequent bond issue under the above bond framework, to be used towards partially finance the acquisition of Sportnco and general corporate purposes. The borrowing limit of SEK 550 million was therefore fully utilised. Bond matures in June 2024. In August, ABG Sundal Collier and Pareto Securities have been appointed as advisors to facilitate the refinancing of the bond, expected in the third quarter 20237.

10 million EUR - other payables.

Deferred payment for the AskGamblers acquisition - second instalment to be paid on 31 January 2024.

9.3 million EUR - contingent liability.

Contingent consideration (earn-out) related to the Sportnco acquisition. GiG agreed to pay the former shareholders of Sportnco a two year earn-out based on the performance in 2022 and 2023 with up to EUR 11.5 million per year (undiscounted). The earn-out will be paid 50% in cash and 50% in new shares in GiG. The 2022 earn-out was paid in May 2023, and the 2023 earn-out is expected in April 20248.

5.4 million EUR - short term loan:

3.7 million EUR - related to debt acquired upon the acquisition of Sportnco.

~1.7 million EUR - 20 million NOK credit facility with a shareholder (maturity on 30 September 2023; the facility has a commitment fee of 3% per annum and an interest rate of 12% per annum).

Long term liabilities:

23.9 million EUR - other long term liabilities:

15 million EUR related to Acquisition of AskGamblers - third instalment to be paid on 31 January 2025.

6.8 million EUR - lease liabilities.

10.9 million EUR - long term bank loans.

Fully related to debt acquired upon the acquisition of Sportnco.

High level composition of GIG’s balance sheet:

Given the interest GIG is paying on its current debt, the credit rating of the company is average at best. With the current ability of GIG’s business to generate cash from operating activities, the financial position should improve quickly.

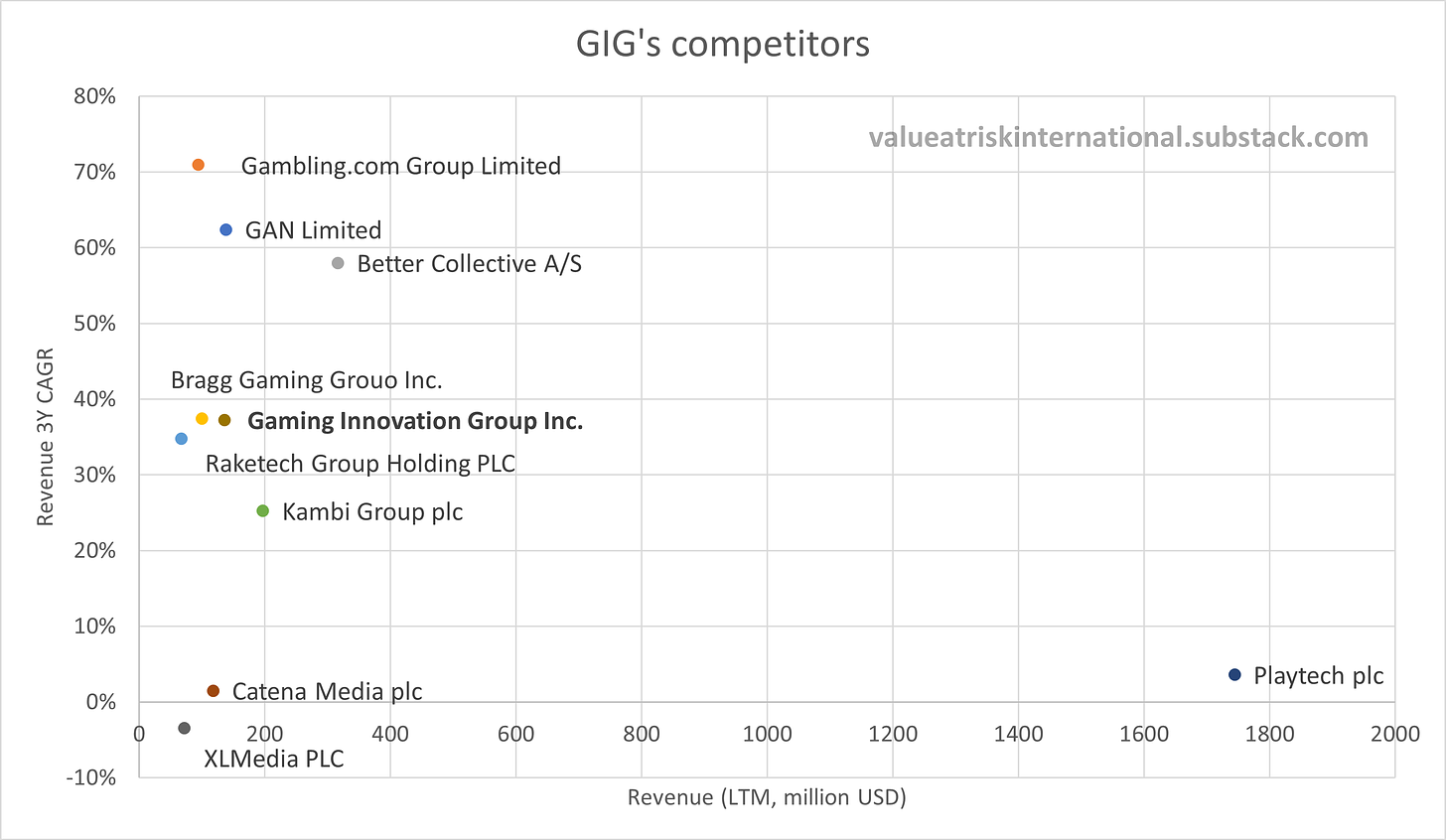

Competitors

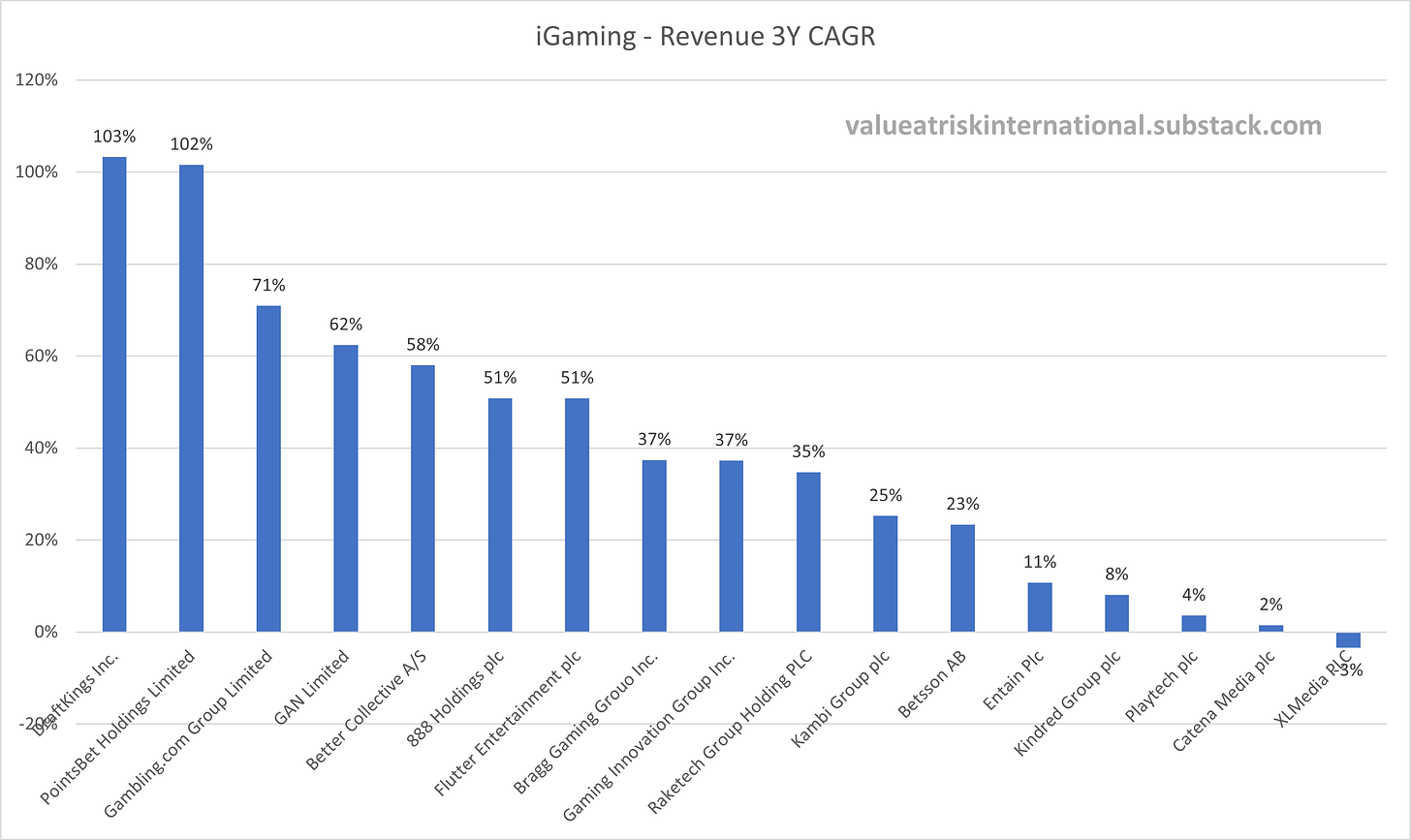

There are many companies offering a wide range of B2B products and services for iGaming industry. GIG’s biggest competitors on a global scale are Better Collective, XLMedia and Gambling.com in Media space and Playtech in Platform & Sportsbook.

Better Collective [STO:BETCO]

Better Collective’s newly established vision is to become the Leading Digital Sports Media Group. Through our owned and operated sports media and sports communities we provide our users with innovative products that via educational, transparent, and responsible content guides them in the world of sports. Our mission is to build sports media as well as communities that engage, entertain, inform, and inspire action. Our sports brands cover more than 30 languages and attract more than 150 million monthly visitors of which many return again and again. Our offerings include quality sports content, communities, data insights, podcasts, video content, apps and innovative technology9.

XLMedia [LON:XLM]

XLMedia is a leading global digital media company that creates compelling content for highly engaged audiences and connects them to relevant advertisers.

The Group manages a portfolio of premium brands with a primary emphasis on Sports and Gaming in regulated markets. XLMedia brands are designed to reach passionate people, build relationships, and provide the right advertisements at the right time to the right audiences10.

Gambling.com [NASDAQ:GAMB]

Gambling.com leads the way in consumer education and online engagement for those interested in any form of online gambling across 9 different countries and 4 different languages. The company publishes free-to-use websites which allow consumers to compare online gambling services.

We are represented globally via our expert teams in the UK, Ireland, USA and Malta who strive to deliver up to date unbiased coverage of the gambling industry with reviews of online betting and casino operators, industry news and legislation updates, knowledge, strategy and edge tools and safety information for when gambling online anywhere in the World11.

Playtech [LON:PTEC]

Founded in 1999 and premium listed on the Main Market of the London Stock Exchange, Playtech is a technology leader in the gambling and financial trading industries with over 6,600 employees across 26 countries.

Playtech is the gambling industry's leading technology company delivering business intelligence driven gambling software, services, content and platform technology across the industry’s most popular product verticals, including, casino, live casino, sports betting, virtual sports, bingo and poker. It is the pioneer of omni-channel gambling technology through its integrated platform technology, Playtech ONE. Playtech ONE delivers data driven marketing expertise, single wallet functionality, CRM and responsible gambling solutions across one single platform across product verticals and across retail and online.

Playtech partners with and invests in the leading brands in regulated and newly regulated markets to deliver its data driven gambling technology across the retail and online value chain. Playtech provides its technology on a B2B basis to the industry’s leading retail and online operators, land-based casino groups and government sponsored entities such as lotteries12.

Other competitors in Media space that are worth mentioning are Catena Media and Raketech. For Platform business, EveryMatrix, Strive, Bragg and GAN can be highlighted. On top of that Kambi, FSB and Amelco are competitors in Sportsbook area.

More on the industry

The industry is quite challenging from analytical point of view. The regulations change and can quickly throw away any investment thesis. Even though the industry is regulated, there are many grey areas. Some companies deliberately look to abuse the regulations to get competitive advantage.

It seems that at the moment all the companies in the industry are looking to put their feet in the door to US sports betting market. In 2018, Supreme Court overturned a law prohibiting most states from legalizing sports betting and now individual states have the right to regulate gambling as they see fit. At the moment many states decide to change the law to more friendly for gambling industry. There is also a lot to do in the US market in terms of digitalisation.

According to Goldman Sachs, US market should grow rapidly till 2033 when it is supposed to mature. US iGaming market is dominated by two players - BetMGM and DraftKings. There are multiple smaller companies fighting for the remaining market share. All of them are looking to expand their business and they can be open to partnerships with companies such as GIG.

Other area of the world that is getting a lot of attention from the industry at the moment is LATAM. The region has significant population. Internet and smartphone penetration rates are growing. Gambling regulations vary country to country but overall they are being changed to more favourable for operators.

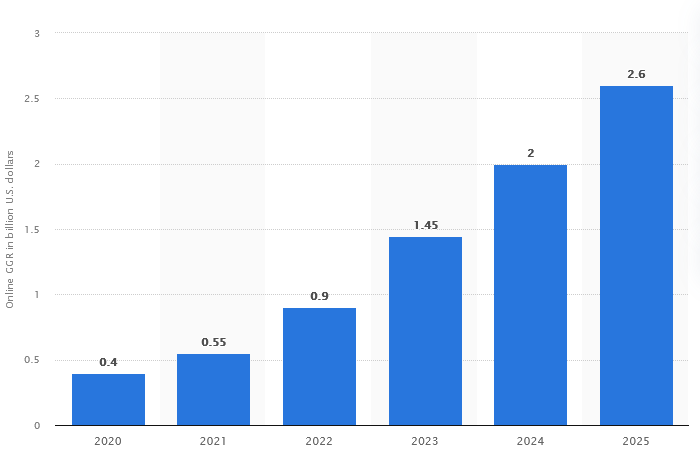

Online gross gaming revenue (GGR) in Latin America in 2020, with forecast until 2025 (billion USD)

There has always been a lot of M&A activity in the sector, which may lead to overall consolidation. In theory this may give more bargaining power to buyers of B2B services in the future. But at least for now, the business environment for companies operating in iGaming sector seems to be friendly. Many companies have significantly expanded their operations over last couple of years.

Valuation

GIG’s market capitalisation as of 4th of September is roughly 3 800 million SEK. The stock price has been steadily going up since April 2020.

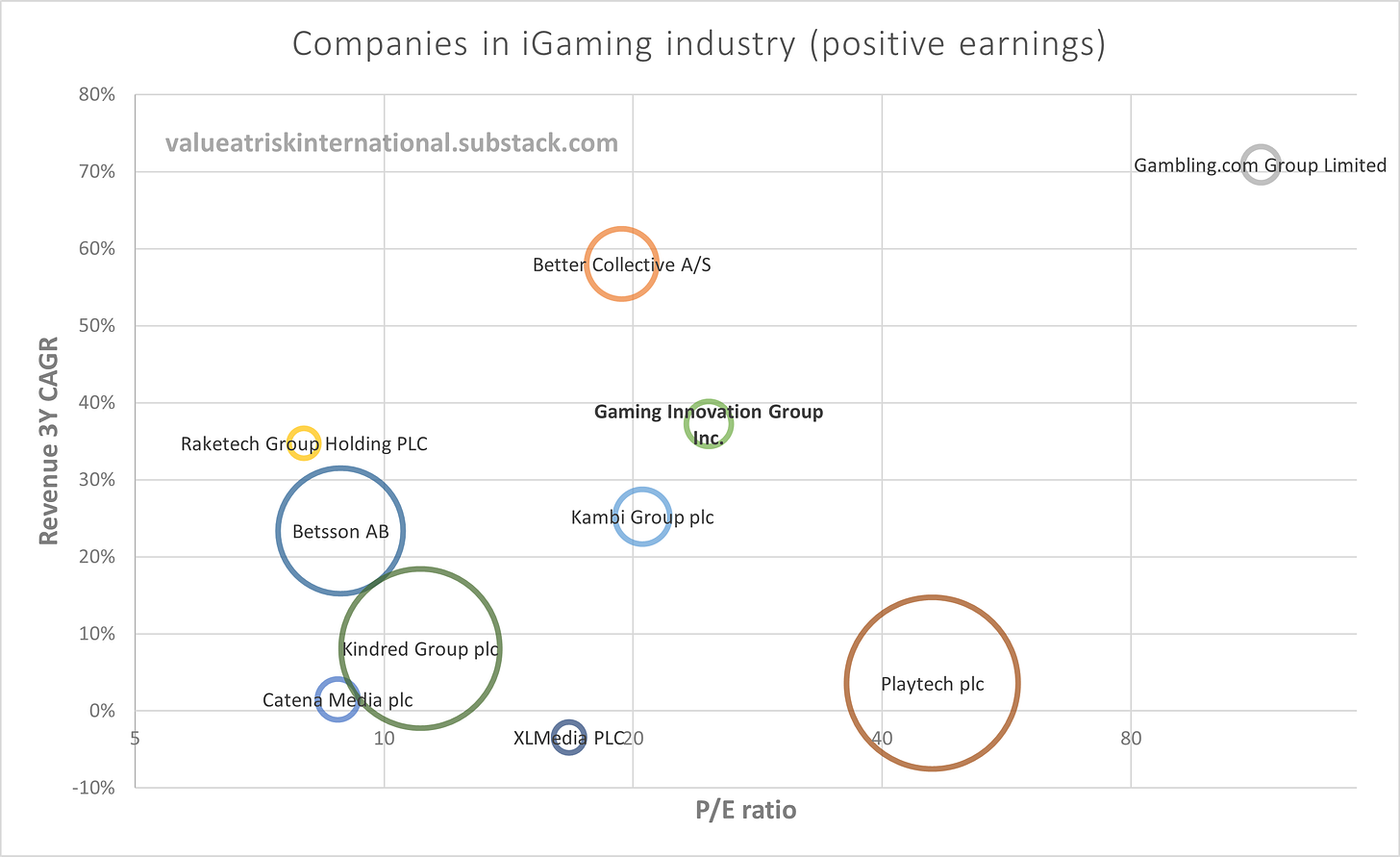

GIG is not cheap when compared to other companies in the sector, but it is all due to topline growth potential and future margin expansion. Current P/E ratio is ~26 with forward P/E that can be estimated at 10-15 (next 12 months). On the chart below, circle radius represents market cap.

The stock is trading in Stockholm and Oslo. SEK has been weakening for last couple of years. Sweden has been capital exporter for years and with current high inflation and low interest rates the trend has steepened. NOK chart looks similar. Continuation of existing trend can be viewed as additional risk.

Summary

iGaming is challenging, but a very interesting industry with a lot of potential for future growth. GIG went through rough times recently, but it looks like the business has a very positive momentum at the moment. As long as the current revenue growth trend continues, the market cap does not seem to be very high. Significant percentage of GIG’s revenues are re-occurring and there are big benefits from scaling the operations. There are clients waiting to go live, so the financial results are very likely to improve over upcoming quarters. The recent acquisitions are still in integration phase so the synergies have not been fully reflected on the income statement yet.

Pros:

GIG’s revenue very likely to keep on growing in upcoming quarters due to re-occurring nature of revenues and new clients and brands awaiting onboarding.

GIG’s Platform & Sportsbook is essentially SaaS business. Media revenues are heavily based on revenue share model, so there should be a snowball effect for future financial results.

Operational leverage benefits are just starting to be visible on GIG’s income statement.

Positive secular trends for the entire industry (regulation, offline to online transition).

Cons:

High risk of bad capital allocation related to GIG’s future M&A activity.

Changes in management team (successful CEO to step down) combined with high operational risk related to upcoming split of the company.

Risk of gambling advertising ban on particular markets, which can have negative effect on Media business.

From pure investment perspective: FX risk - SEK and NOK continue to weaken, but historically they are very cheap, so this may turn out either way.

If you find this type of content useful, please subscribe and stay up to date.

You can expect ~10 emails per year with high-quality content. No spam!

If you are looking for more high quality equity research, take a look at value at risk newsletter in Polish. You can use tools such as Chat GPT to translate it to your native language.

I also encourage you to follow my profile on Twitter @BrowarekMateusz.

Roundhill, BETZ Investment Case, June 2023

GIG

https://www.gig.com/ir-news/gaming-innovation-group-appoints-richard-carter-as-platform-sportsbook-ceo

GIG

GIG

GIG

GIG

GIG

Better Collective

XLMedia

Gambling.com

Playtech

Thank you for great analysis. Do you consider stock purchases on Swedish/Norwegian market considering high taxes there (30/35% if Im not mistaken)?

Don’t you think they have too much debt at high interest rates? Do you think they could pay it with no problem? Thanks for the research, great write up and great company